“Members of the Shorecrest community need the support of advocates, allies, and accomplices, and the Human Rights Club is there for Shorecrest in this way,” said US English Teacher and Club Sponsor Heather Elouej when asked about the Human Rights Club’s role in the Shorecrest community.

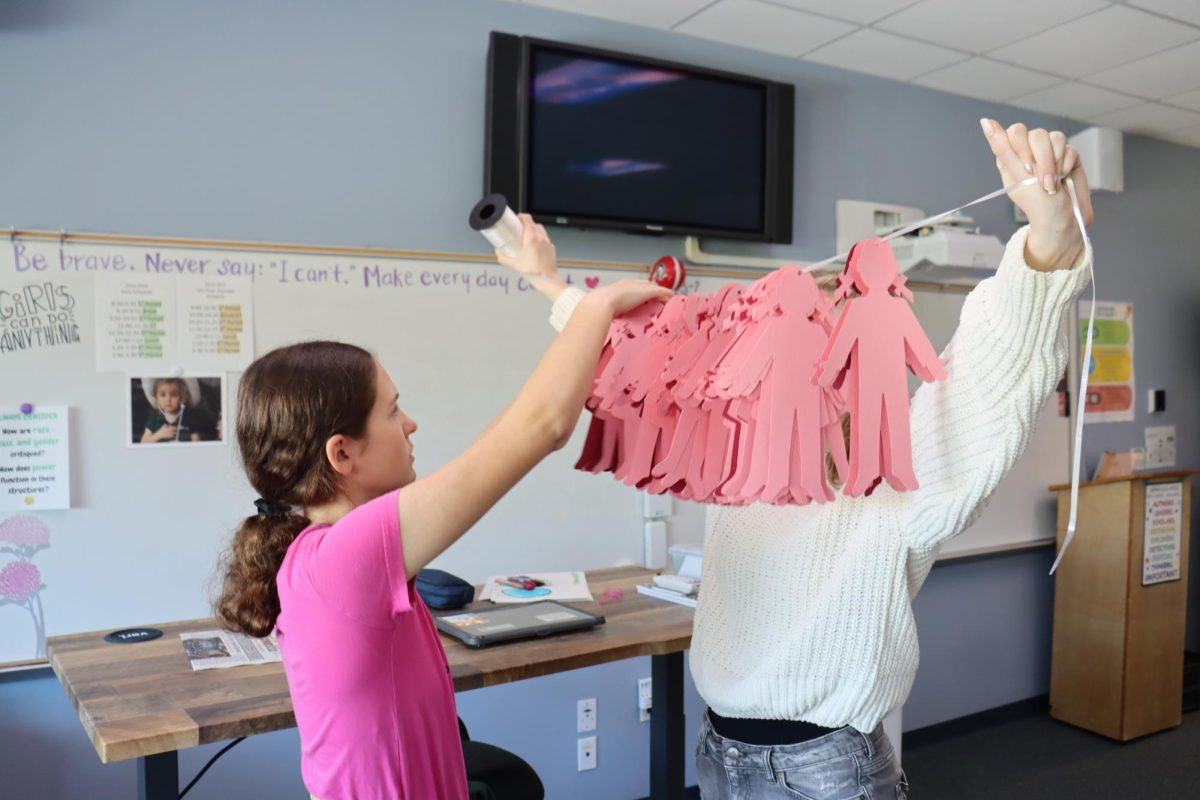

In 2024, the Human Rights Club is working to finish its Paper People Project, aiming to educate the student body about the frequency of gun violence in American schools. Spearheaded by juniors Arden Katcha and Cole Oman, Co-Presidents of the club, the project’s planning began last February and is estimated to be completed before winter break.

“Our goal is to hang up little [paper] people, each representing a certain number of victims of gun violence in the US,” said Oman. “The only reason we’re doing this is to bring awareness, to remind people that this is going on in our country because it’s very easy to forget when it’s not in the news headlines every day; it doesn’t mean it’s not happening.”

In preparation, members spent time researching statistics to write on their paper cutouts taken from a K-12 news website called Education Week. “We’re doing [the project] based on 2023 and 2024 data,” said Katcha. “On each person will be the school’s name and the date it took place. The goal is that each paper person represents either an injury, on pink [paper], or a death, on red [paper], to quantify the grand scale of this problem.”

However, addressing such an emotional topic hasn’t been easy. “We really don’t want to scare people. We don’t want to be like, ‘Your school is going to be next,’ [that’s] not the truth,” said Oman. “As sad as it is, this is one of the major issues that impacts schools the most.”

Addressing significant issues like gun violence is what the club primarily focuses on. Their mission is “to inspire others to advocate for those who find adversity in speaking up for themselves,” which they work to embody with each project they complete, such as their annual diaper drive.

“If everyone’s human rights were respected across the globe, then the Human Rights Club could shift its mission to maintaining, to preserving that level of respect,” said Elouej. “Until then, we’ll keep researching, spreading awareness, and advocating against human rights violations.”

Katcha emphasized the importance of this project. “[Our goal] is to spread awareness, to not only kids who are going to be the future in politics and future in the world but to bring awareness to their parents. If [our projects] can bring just a little bit of impact, a little can do so much,” she said.

Ultimately, behind the club’s accomplishments are its members who are determined to make a difference, and the Paper People Project is a testament to that.

“Everyone who chooses to join and to lead the Human Rights Club is the kind of person I want to surround myself with,” said Elouej. “These are the people who operate with compassion, empathy, and bravery in their everyday lives…I feel better about the future, knowing there are folks like these kids who will move into life beyond Shorecrest with consideration for—and a will to fight for—their fellow humans.”

![Thespians pose on a staircase at the District IV Thespian Festival. [Front to back] Luca Baker, Maddison Cirino, Tanyiah Ellison, Alex Lewis, Summer Farkas, Jill Marcus, Ella Mathews, Sanjay Sinha, Isabella Jank, Sofia Lee, Boston Littlepage-Santana, Sally Keane, Tyler Biggar, Tanner Johnson, Jasper Hallock-Wishner, Remy de Paris, Alex Jank, Kaelie Dieter, and Daniel Cooper. Photo by Michael McCarthy.](https://spschronicle.org/wp-content/uploads/2024/12/image1-900x1200.jpg)